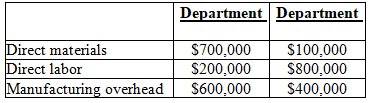

Apple Valley Corporation uses a job order cost system and has two production departments, A and B. Budgeted manufacturing costs for the year are:

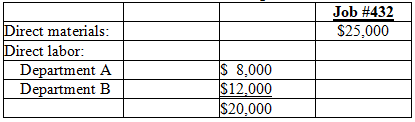

The actual material and labor costs charged to Job #432 are as follows:  Apple Valley applies manufacturing overhead costs to jobs on the basis of direct labor cost using departmental rates determined at the beginning of the year.

Apple Valley applies manufacturing overhead costs to jobs on the basis of direct labor cost using departmental rates determined at the beginning of the year.

-For Department A,the manufacturing overhead cost driver rate is:

Definitions:

Cash Dividend

A payment made by a company out of its earnings to shareholders, usually in the form of cash.

Liability

Financial obligations or debts owed by a company to creditors, typically due in the near or distant future.

Declaration Date

The date on which the board of directors officially approves a dividend.

Earnings Per Share

A profitability measurement that calculates the amount of net income earned per share of stock outstanding.

Q6: In a centralized organization:<br>A)local-division managers do not

Q10: A cost that depends on the amount

Q11: Transfer prices based on actual costs provide

Q26: Nonprofit and government organizations success must be

Q49: Overcosting a particular product may result in:<br>A)gain

Q54: Activity-based management (ABM)includes decisions about all of

Q63: Why do product costing systems using the

Q66: Does adding more cost pools always result

Q79: For October,budgeted net income is:<br>A)$20,000.<br>B)$30,000.<br>C)$40,000.<br>D)None of the

Q137: The flexible budget will report $_ for