Baldwin Printers has contracts to complete weekly supplements required by forty-two customers. For the year 2011, manufacturing overhead cost estimates total $1,840,000 for an annual production capacity of 20 million pages.

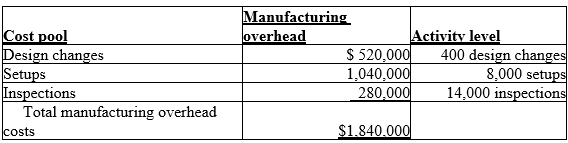

For 2011 Baldwin Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

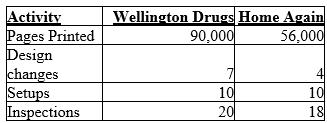

During 2011, two customers, Wellington Drugs and Home Again, are expected to use the following printing services:

-When overhead costs are assigned using the single cost driver,number of pages printed,then

Definitions:

Tariffs

Taxes imposed by a government on imported or exported goods.

United States

A country located in North America, consisting of 50 states, a federal district, five major self-governing territories, and various possessions, known for its large economy and advanced technology.

Import

The act of bringing goods or services into a country from abroad for sale.

U.S. Tariff

A tax imposed by the United States government on imported or, less commonly, exported goods.

Q3: Updates to time-driven ABC models are triggered

Q9: Department income totals $200,000,investment in the department

Q14: The MAJOR criticism of using return on

Q25: A local unit is evaluated as a

Q35: Sunk costs:<br>A)are relevant.<br>B)are differential.<br>C)have future implications.<br>D)are ignored

Q66: Brilliant Accents Company manufactures and sells three

Q75: After the change,sales are projected to increase

Q93: _ is output returned to appropriate members

Q94: Relevant costs for this decision include:<br>A)the original

Q98: Describe a variable cost.Describe a fixed cost.Explain