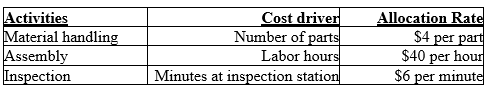

Merrill, Inc. manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead costs. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead costs based on direct labor hours using a rate of $ 400 per labor hour.

-What are the manufacturing overhead costs per remote control assuming the traditional cost method is used and a batch of 500 remote controls are produced? The batch requires 1,000 parts,10 direct labor hours,and 15 minutes of inspection time.

Definitions:

Price Discrimination

Involves selling the same product to different customers at different prices based on what each is willing to pay, rather than differences in production cost.

Price Discrimination

The practice of charging different prices for the same product or service to different consumers, based on what each is willing to pay.

Senior Citizens

Individuals of an advanced age, often defined as being 65 years old or older, who may have different social, economic, and healthcare needs.

Walmart

An American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores, known for its scale and efficiency in supply chain management.

Q28: (Appendix)The direct method of allocating service department

Q57: Behavioral considerations of a well-designed management accounting

Q60: A cost that is uniquely and unequivocally

Q65: The objective to discover and develop new,more

Q68: In job order costing,individual jobs and products

Q77: If Marine Industrial Coatings replaces the existing

Q83: List at least three factors taken into

Q90: Process costing systems are used when products

Q94: The estimated direct labor cost for this

Q108: Information systems literacy describes the behavioral approach