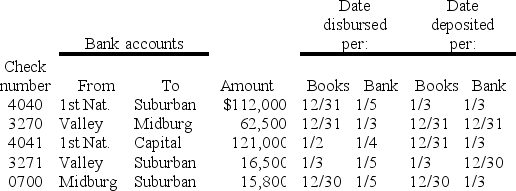

Flemco has made a series of transfers between bank accounts near year-end,some through inter-bank wired transfers and some through checks.You have audited the wired transfers and agree that they have been properly stated and now have the following schedule of transfers between cash accounts made using checks.You may assume that dates per bank are correct,and that dates per books are the dates the transactions were recorded in the books.

Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct,overstated,or understated as of year-end.

Definitions:

Q2: The existence of a material weakness led

Q3: Which of the following is a weakness

Q22: What ultimately determines the specific audit procedures

Q31: An auditor should expect that fair value

Q32: The definition of internal control developed by

Q33: Accounts payable from an officer should be

Q38: Which of the following policies is an

Q56: Which of the following controls would be

Q60: By preparing a four-column bank reconciliation ("proof

Q62: Which of the following is <b>least </b>likely