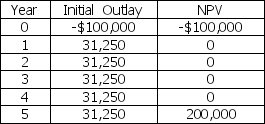

The Bolster Company is considering two mutually exclusive projects:

The required rate of return on these projects is 12 percent.

a.What is each project's payback period?

b.What is each project's discounted payback period?

c.What is each project's net present value?

d.What is each project's internal rate of return?

e.Fully explain the results of your analysis.Which project do you prefer,and why?

Definitions:

Mann-Whitney Test

A nonparametric test used to assess whether there is a significant difference between two independent samples, an alternative to the t-test when certain assumptions are not met.

Sign Test

A non-parametric test used to determine if there is a significant difference between the median of two dependent samples.

Two-sample T-test

A statistical method to determine if there is a significant difference between the means of two groups, which may have different variances.

Wilcoxon Signed Rank

The Wilcoxon Signed Rank test is a nonparametric statistical test used to compare two related samples to assess whether their population mean ranks differ.

Q1: Two key components of a prudent capital

Q5: An EBIT-EPS analysis allows the decision maker

Q9: You are a retired worker whose income

Q39: Operating leverage refers to<br>A) financing a portion

Q42: A project's standing alone risk allows for

Q54: Flotation costs<br>A) include the fees paid to

Q70: An independent project should be accepted if

Q136: Assume that the tax on dividends and

Q137: Which of the following is NOT an

Q139: Assume that a firm has a steady