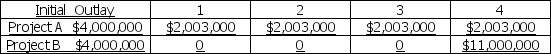

Consider the following two projects:

Net Cash Flow Each Period

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Definitions:

Registration

The process of officially recording or enrolling something or someone in a list, database, or system, often for legal, official, or regulatory purposes.

Probability Of Failure

The likelihood, often expressed as a percentage or ratio, that a system or component will not perform its intended function within a specified period.

Service Reliability

The consistency and dependability of a service provider in delivering promised services to customers at the required performance level.

Electrical Motor

A device that converts electrical energy into mechanical energy, often used in various machines and vehicles.

Q2: Since stockholders are able to reduce their

Q35: If a project has multiple internal rates

Q48: A corporation has been paying out $1

Q63: Advantages of the payback period include that

Q71: All of the following are considered organizational

Q91: Issuing new short-term bonds to finance an

Q95: Business risk refers to the relative dispersion

Q118: The major contribution of change-oriented and visionary

Q133: For any individual project,if the project is

Q142: In break-even analysis,semivariable costs are segregated into