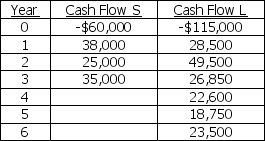

The Meacham Tire Company is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

The required rate of return on these projects is 14 percent.What decision should be made? As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

Definitions:

Equity Financing

The method of raising capital by selling company shares to investors; in return, the investors receive ownership interests in the company.

Rate of Return

The gain or loss on an investment over a specified period, expressed as a percentage of the investment's initial cost.

Debt Financing

Debt Financing involves raising capital through borrowing money that must be repaid over time, with interest.

Cost of Capital

The return a company needs to earn on its investment projects to maintain its value and attract funds.

Q8: The ex-dividend date is typically two days

Q10: AFB,Inc.requires an investment in equipment of $600,000

Q38: A grocery store decides to offer beer

Q58: The Modigliani and Miller hypothesis suggests that

Q59: 3M implemented the Six Sigma process that

Q66: A small,family-owned corporation would be more likely

Q85: If we ignore bankruptcy and agency costs

Q120: D&B Contracting plans to purchase a new

Q142: The recent financial crises was exacerbated by<br>A)

Q157: If the NPV (Net Present Value)of a