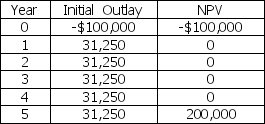

The Bolster Company is considering two mutually exclusive projects:

The required rate of return on these projects is 12 percent.

a.What is each project's payback period?

b.What is each project's discounted payback period?

c.What is each project's net present value?

d.What is each project's internal rate of return?

e.Fully explain the results of your analysis.Which project do you prefer,and why?

Definitions:

Tutoring

The act of providing personal or group instruction or assistance in a particular subject or skill, aiming to improve the learner's understanding or proficiency.

Invoiced

The process of sending a document to a customer indicating amounts owed for goods or services provided.

Prepaid Insurance

An asset account that represents insurance premiums paid in advance for coverage extending beyond the current accounting period.

Expired Insurance

Insurance coverage that has reached the end of its policy term and is no longer in effect.

Q9: Creativity is also known as vertical thinking.

Q39: A limited partnership provides limited liability to<br>A)

Q43: IRR should not be used to choose

Q49: Because financial markets can be extremely volatile,with

Q50: _ focuses on the application of knowledge

Q61: Basic tools of capital-structure management include<br>A) EBIT-EPS

Q68: Grainery Distillers,Inc.is experiencing high demand for its

Q75: Lithium,Inc.is considering two mutually exclusive projects,A and

Q78: The Clydesdale Corporation has an optimal capital

Q138: An asset with an original cost of