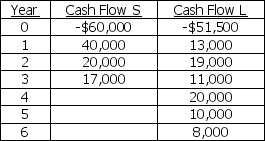

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Definitions:

Temperament

An individual's innate predisposition towards emotional responses and behaviors, often evident from infancy.

Infancy

The period in human development from birth to about 18 months when a child is learning basic motor skills, developing cognitively, and beginning to engage socially.

Synchrony

The coordinated, simultaneous action or occurrence of events or processes, often seen in natural and human-made systems.

Vocal Expressions

Sounds and tones used by an individual to convey emotions, thoughts, or information.

Q30: Whereas_ addresses the content of the

Q32: Two projects that have the same cost

Q46: What is an incremental cash flow? What

Q59: In general,a project's free cash flows will

Q90: Your company is considering the replacement of

Q92: Cultures that value_ ,can focus the

Q95: In a perfect market,investors are only concerned

Q100: The net present value always provides the

Q101: _ refers to the process of personal

Q119: Which of the following should be included