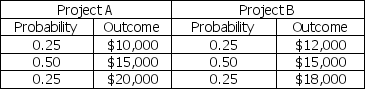

John Q.Enterprises is considering two potential investments.The probability distributions of annual end-of-year cash flows for the respective projects are:

Both projects will require an initial outlay of $45,000 and will have an estimated life of 6 years.Project A is considered a riskier investment and will have to have a risk-adjusted required rate of return of 15%,while Project B's risk-adjusted required rate of return is 12%.

a.Determine the expected value of each project's annual cash flow.

b.Determine each project's risk-adjusted net present value.

Definitions:

Feedback

Information given to a person or system about its performance or behavior, which may be used as a basis for improvement.

Technical Design

The process of creating solutions to technical problems, including the drafting of blueprints, specifications, and the overall planning of systems or products.

Social Design

The practice of designing environments, products, and services with the intention to improve human interactions and society as a whole.

Social Dilemma

Situations in which personal interests are at odds with the collective good, challenging the harmony between individual actions and group welfare.

Q7: Many financial managers believe the payback period

Q13: Beginning in 2007 the United States experienced

Q24: The tax shield on interest is calculated

Q25: All of the following are methods available

Q29: Cash flows and profits are synonymous; in

Q68: Discretionary financing needed will be zero when

Q75: Fixed operating costs include charges incurred from

Q78: The objective of capital structure management is

Q82: Which of the following should be included

Q91: Because there are no fixed financing costs,a