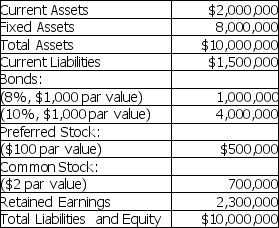

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows:

MAX Corporation

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Definitions:

Microtubule

Hollow tube composed of tubulin, measuring approximately 25 nm in diameter and usually several micro meters long. Helps provide support to the cytoplasm of the cell and is a component of certain cell organelles, such as centrioles, spindle fibers, cilia, and flagella.

Lysosomes

Organelles in cells that contain enzymes used to break down and recycle cellular debris and foreign substances.

White Blood Cell

A type of immune cell that is crucial in defending the body against infection and disease.

Fibroblast

Fibroblasts are the most common cells of connective tissue in animals, which produce and maintain the extracellular matrix, playing a crucial role in wound healing and tissue repair.

Q5: Shareholders may prefer a share repurchase program

Q8: A firm's cash position would most likely

Q17: The guiding rule in deciding if a

Q61: A project would be acceptable if<br>A) the

Q70: A cross rate is the computation of

Q77: Limited partnerships are not as prevalent as

Q85: If we ignore bankruptcy and agency costs

Q107: Using simulation provides the financial manager with

Q108: Terminal cash flows are always positive because

Q119: A company that sells preferred stock and