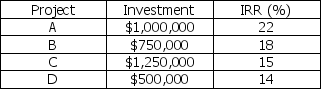

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected? Assume the marginal cost of capital is constant.

Definitions:

Modern Firms

Refers to contemporary businesses characterized by innovative practices, technology use, and agile structures.

Foreign Countries

Nations or territories outside one's own country, governed by distinct legal, political, and cultural systems.

Independent Contractor

An individual or entity contracted to perform work for another entity as a non-employee, typically retaining control over how their work is completed.

Employee

An individual who is hired by a company to perform specific duties in exchange for compensation, typically under the control and direction of the employer.

Q27: Which of the following is a spontaneous

Q51: Which of the following should be excluded

Q80: One method of accounting for systematic risk

Q83: The CFO of Twine Enterprises expects sales

Q84: Exchange-rate risk arises from the fact that

Q100: Corporations utilize external financing either because they

Q104: The difference between the capital gains tax

Q113: Suppose the 360-day forward exchange rate is

Q153: Advantages of using simulation include<br>A) adjustment for

Q165: A stock split is defined as a