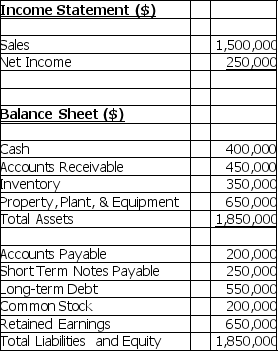

Using the 2012 financial statements for DRE Corporation and this additional information,prepare a pro forma income statement and balance sheet for the year 2013.Determine the discretionary financing needed (DFN)and assume that if the DFN is positive,the company will increase long-term debt,and if DFN is negative,the company will pay back some long-term debt.

Sales for next year (2013)are expected to increase by $300,000 to $1,800,000.The firm is running efficiently and at full capacity so that all assets and spontaneous liabilities are expected to increase proportionally with sales.The dividend payout ratio for 2013 will be 40%.

DRE Corporation

2012 Financial Statements

Definitions:

Bricklayers

Skilled tradespeople who lay bricks to construct brickwork, which includes walls, foundations, and other structures.

White Men

A demographic group characterized by individuals of European descent, often discussed in sociological and demographic studies.

Ethnicity

A category of people who identify with each other based on common ancestral, social, cultural, or national experiences.

Perfectly Competitive

A market structure where many firms sell identical products, no barriers to entry exist, and no single buyer or seller can affect the market price.

Q41: Credit terms of 2/10,net 30 have a

Q44: The cash conversion cycle is a measure

Q72: A company's investment in accounts receivable is

Q82: Using the percent of sales method,projected common

Q83: The CFO of Twine Enterprises expects sales

Q106: Variable costs include all of the following

Q117: What is the difference between a stock

Q135: As a corporation's investment opportunities increase,the dividend

Q166: Other things equal,in imperfect markets a firm

Q167: The trade-off associated with holding large amounts