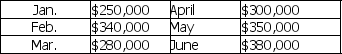

Fielding Wilderness Outfitters had projected its sales for the first six months of 2010 to be as follows:

Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2010 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2010.Assume that the interest rate on short-term borrowing is 1% per month.What is Fielding's projected total receipts (collections) for April?

Definitions:

Liquidated Assets

Assets that have been converted into cash or cash equivalents, often during the process of paying off debt or during liquidation of a company.

Partnership Debt

Partnership debt is the financial obligations that a partnership entity owes to creditors, which are typically shared among the partners according to their agreement.

Limited Partnership

A partnership arrangement in which some partners are only liable up to the amount of their investment, unlike general partners who have unlimited liability.

Limited Liability Company

A business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Q1: What differentiates "discretionary financing needs" from "external

Q3: One potential reason for a share repurchase

Q34: Float is best described by which of

Q56: Problems of multinationals include<br>A) cash management and

Q100: Identify and explain three different dividend policies.

Q109: The spot exchange rate is 1.57 dollars

Q119: Purchasing supplies on credit and paying for

Q120: Which of the following is the most

Q125: AFB Corp.Declared a $1.00 dividend on January

Q178: Howton Mining expects to have credit sales