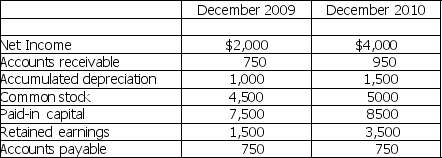

Please refer to Table 3-1 for the following questions.

Table 3-1

Jones Company

Financial Information

-Based on the information in Table 3-1,calculate the after-tax cash flow from operations for 2008 (no assets were disposed of during the year,and there was no change in interest payable or taxes payable) .

Definitions:

Interest Expense

The cost incurred by an entity for borrowed funds, reflected in its income statement.

Tax Rate

The percentage at which an individual or corporation is taxed by the government.

Net Profit Margin Percentage

A financial metric that shows the percentage of revenue that remains as profit after all expenses have been subtracted from total sales.

Net Operating Income

A measure of a company's profitability from its regular business operations, excluding expenses and revenues from non-operational activities.

Q1: In addition to the information contained in

Q13: Assume that an investment is forecasted to

Q18: Financial ratios are used by personnel in

Q27: A company concerned about the liquidity of

Q29: The statement of cash flow explains the

Q33: HighLev Incorporated borrows heavily and uses the

Q64: Financial ratios that are higher than industry

Q75: You are going to add one of

Q84: Anchor Incorporated has a beta of 1.0.If

Q151: If the interest rate is positive,a six-year