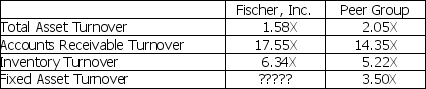

Asset efficiency ratios for Fischer,Inc.are given in the table below.Based on this information,Fischer,Inc.'s fixed asset turnover ratio is likely to be ________.

Definitions:

Accounts Receivable

Funds that customers owe to a company for products or services they have received but have not yet compensated for.

Inventory

The total amount of goods that a company holds, intending to sell them in the normal course of business.

Financing Activities

Transactions that result in changes in the size and composition of the equity capital or borrowings of a company.

Cash Flow

The total volume of financial transfers happening within a business, crucially affecting its ability to handle financial obligations.

Q12: The same underlying formula is used for

Q38: You sell valuable artifacts from your household

Q60: Which of the following would be an

Q77: Progressive Corporation issued callable bonds.The bonds are

Q86: Given the anticipated rate of inflation (i)of

Q105: Valley Manufacturing Inc.just issued $1,000 par 20-year

Q112: Variation in the rate of return of

Q115: A firm's income statement reports the results

Q122: The portfolio beta is simply the sum

Q168: Which of the following is the least