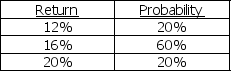

You are given the following probability distribution for XYZ common stock's returns during the next year,which are assumed to be normally distributed.Show all work below,and complete the following:

a.Calculate the standard deviation of the returns,and round to the nearest one-half percent.

b.Draw a graphical representation of XYZ's normal distribution below (ye old bell-shaped curve).LABEL THE AXES OF THE GRAPH OR THE FOLLOWING RESULTS WILL BE MEANINGLESS.Using your result in part A for the standard deviation (rounded to the nearest one-half percent)explain and indicate on the graph,the probability that XYZ will return more than 13.5%,assuming a normal distribution.

Definitions:

Shifting Resources

The process of reallocating resources from one use to another, often in response to changes in market conditions or economic priorities.

Production Process

The series of steps and operations involved in the manufacturing of a product or the delivery of a service.

Price Inelastic

Describes a situation in which the demand for a good or service changes little with a change in price.

Extraordinarily Large

A term used to describe a magnitude or amount that significantly exceeds what is common or expected.

Q3: What is the future value of $500

Q3: Common stockholders demand a return on the

Q14: The risk-free rate of return is 3%

Q27: A bond that matures in 5 years

Q30: A stock with a beta of 1

Q65: One weakness of the times interest earned

Q66: Frank Zanca is considering three different investments

Q81: In the case of insolvency,the claims of

Q111: An example of a Eurobond is a

Q111: Andre's wonderful parents established a college savings