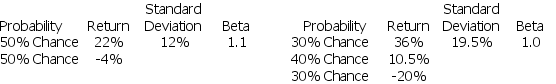

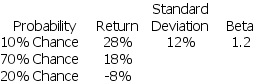

You are going to invest all of your funds in one of three projects with the following distribution of possible returns:

PROJECT 1 PROJECT 2

PROJECT 3

If you are a risk averse investor,which one should you choose?

Definitions:

Savings-Bond Portfolio

A collection of savings bonds held by an individual or entity, often used as a low-risk investment strategy.

Ontario Savings Bonds

Debt securities issued by the Province of Ontario, offering investors a fixed return over a specific period.

Canada Savings Bonds

A type of savings bond issued by the Government of Canada, offering a fixed interest rate over a certain period.

Reduction Of

A decrease in amount, size, intensity, or the number of something, often referring to cost, price, or rates.

Q18: Which of the following statements is MOST

Q33: Rogue Recreation,Inc.has normally distributed returns with an

Q48: Changes in the general economy,like changes in

Q73: A $1,000 par value 14-year bond with

Q81: Based on the information in Table 4-3,the

Q82: Historically,investments with the highest returns have the

Q87: If a bond has a market value

Q117: When solving time value of money problems

Q127: You have been accepted to study international

Q128: How does compound interest differ from simple