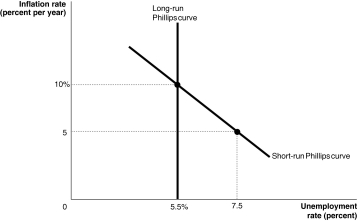

Figure 28-4

-Refer to Figure 28-4.Consider the Phillips curves shown in the above graph. We can conclude from this graph that

Definitions:

FICA Tax

Taxes required by the Federal Insurance Contributions Act, funding Social Security and Medicare benefits.

FUTA Tax

The Federal Unemployment Tax Act tax, which employers pay to help fund state workforce agencies.

SUTA Tax

A state unemployment tax assessed by individual states on employers, used to fund their unemployment insurance and job service programs.

Medicare

A federal health insurance program in the United States primarily for people aged 65 and older, as well as for some younger individuals with disabilities.

Q5: Using the Taylor rule,if the current inflation

Q15: When tax revenues are greater than government

Q38: If the Federal Reserve attempts to continue

Q84: Which of the following would you expect

Q87: If the amount you owe on your

Q95: A decrease in United States net foreign

Q95: Which of the following statements about capital

Q97: Financial intermediaries<br>A) provide a channel for linking

Q129: Refer to Table 26-3.Consider the hypothetical information

Q142: When a new depositor opens a checking