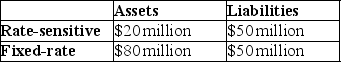

Use the following table to answer the question :

-Assuming that the average duration of its assets is five years,while the average duration of its liabilities is three years,then a 5 percentage point increase in interest rates will cause the net worth of First National to decline by ________ of the total original asset value.

Definitions:

Ending Inventory

The final value of goods available for sale at the end of an accounting period after subtracting the cost of goods sold.

Retail Method

A pricing strategy used in retail to maintain a consistent profit margin by marking up goods based on their wholesale cost.

Retail Method

An accounting method used to estimate ending inventory and cost of goods sold by calculating a cost-to-retail percentage and applying it to the retail price.

Estimated Cost

The anticipated cost to undertake a project or produce a good, used for budgeting and planning purposes.

Q2: Measuring the sensitivity of bank profits to

Q7: If the Bank of Canada wants to

Q20: From 1973 to 1986,the Canadian dollar _

Q34: The MacKay Task Force may recommend that

Q87: If you buy a European call option

Q95: The primary indicator of the Bank of

Q97: The Bank of Canada _ conducting open

Q101: Which of the following are bank assets?<br>A)

Q144: If the desired reserve ratio is ten

Q152: If the desired reserve ratio is ten