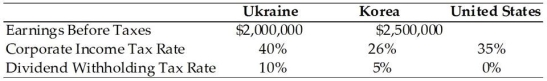

TABLE 15.1

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. If BayArea set the payout rate from the Ukraine subsidiary at 25%, how should BayArea set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill?

Definitions:

Maturity

The specified time in the future when the principal amount of a financial instrument, such as a bond, becomes due and is repaid to the investor.

Bonds

Fixed-income investments representing loans made by an investor to a borrower, typically corporate or governmental.

Real Rate Of Return

The annual rate of return on an investment, adjusted for inflation, reflecting the actual purchasing power of the earnings.

Quoted Price

The stated price at which an asset or service can be bought or sold in the market.

Q5: If management expects a foreign currency to

Q18: The basic advantage of the _ method

Q30: The Eximbank does all of the following

Q39: If the addition of a foreign security

Q39: Affiliate firms are consolidated on the parent's

Q41: A Canadian subsidiary of a U.S. parent

Q46: Based on observations of firms that have

Q49: Which of the following would be considered

Q53: A time draft is payable on presentation

Q61: If inflation is expected to decrease, then<br>A)