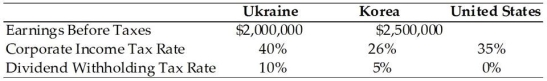

TABLE 15.1

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. If BayArea pays out 50% of its earnings from each subsidiary, what are the additional U.S. taxes due on the foreign sourced income from the Ukraine and Korea respectively?

Definitions:

Virtual Teams

Teams that interact through electronic communications and are often geographically dispersed.

Information Sharing

The exchange of data, knowledge, or information between individuals, teams, or organizations.

Asynchronous

Communication or processes that do not occur in real-time and can be accessed or responded to at different times by different individuals.

Hybrid Teams

Groups blending remote and in-office working members, leveraging flexibility to enhance productivity and collaboration.

Q22: If markets are _, investors could use

Q29: Like a forward market hedge, a money

Q36: A trader who is purchasing a call

Q41: A Canadian subsidiary of a U.S. parent

Q41: The variability of a firm's operating cash

Q45: Today, international trade is dominated by transactions

Q48: Why do the U.S. tax authorities tax

Q49: In general, securities with _ characteristics will

Q56: There is considerable question among investors and

Q65: The crowding-out effect occurs when:<br>A) foreign investors