TABLE 15.1

Use the information for Polaris Corporation to answer following question(s) .

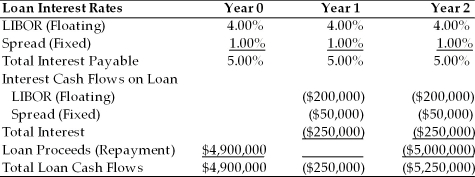

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 15.1. What is the all-in-cost (i.e., the internal rate of return) of the Polaris loan including the LIBOR rate, fixed spread and upfront fee?

Definitions:

Discounted Payback

A capital budgeting method that calculates the time required to recoup the initial investment in present value terms.

Annual Cash Flows

The total amount of money that is transferred into and out of a business, project, or investment within a year.

Required Rate

The minimum return that investors expect to earn when they invest in a project, often used as the discount rate in capital budgeting.

Straight-line Depreciation

A method for dispersing the cost of a physical asset across its useful life in even annual allocations.

Q16: Which of the following is NOT an

Q27: A letter of credit is an agreement

Q32: How does counterparty risk influence a firm's

Q35: Refer to Instruction 9.1. The cost of

Q45: Refer to Instruction 9.1. A _ hedge

Q45: Obtaining local currency debt obligations is particularly

Q47: Refer to Table 21.1. How much in

Q48: Which of the following are not contributing

Q50: Refer to Instruction 9.2. If OTI chooses

Q81: A change from the use of less