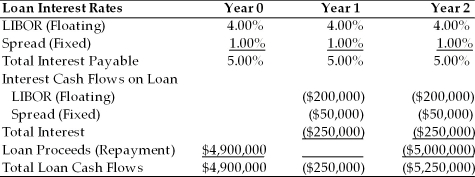

TABLE 15.1

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer Table 15.1. If the LIBOR rate jumps to 5.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

Definitions:

Q2: A U.S. firm sells merchandise today to

Q8: Most financial theorists believe that the optimal

Q14: A tax that is a form of

Q28: The Sharpe Measure of portfolio performance calculates

Q29: Which of the following is NOT a

Q30: A country CANNOT have both a territorial

Q39: Which of the following is NOT an

Q40: A robot on an assembly line would

Q40: A/an _ subsidiary is one in which

Q40: The world's third largest aircraft maker after