TABLE 15.1

Use the information for Polaris Corporation to answer following question(s) .

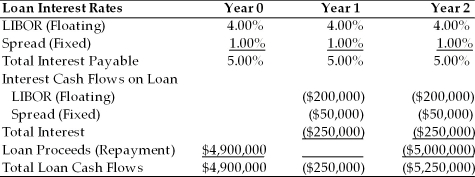

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 15.1. What is the all-in-cost (i.e., the internal rate of return) of the Polaris loan including the LIBOR rate, fixed spread and upfront fee?

Definitions:

Budgeting

A financial planning process for projecting revenues, expenses, and savings goals for a specific period of time.

Net Operating Income

The total profit of a business after subtracting operating expenses but before deducting taxes and interest.

Customers Served

The number of unique clients or customers that a business has provided products or services to within a specific period.

Variance

The difference between planned or expected results and actual results in financial and operational metrics.

Q4: FDI is<br>A) investment in real assets in

Q6: The modern Eurodollar market has been operating

Q10: Eurobanks are<br>A) banks where Eurocurrencies are deposited.<br>B)

Q11: Dash Brevenshure works for the currency trading

Q15: The person or company to whom the

Q25: Which of the following is NOT one

Q30: A fundamental problem of international trade is<br>A)

Q38: An agreement to swap a fixed interest

Q56: Refer to Table 19.1. The NPV for

Q62: Some firms use "leads" or "lags" to