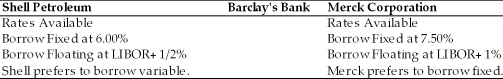

TABLE 15.2

Use the information to answer following question(s) .

-Refer to Table 15.2. Which of the following swap agreements could work for Shell and Merck with Barclay's as the facilitating bank?

Definitions:

Bond Payable

A long-term liability account that represents a promise to pay a series of payments over time and repay the principal amount at maturity.

Bondholder

An investor or entity that owns bonds issued by corporations or governments, entitling them to receive the bond's face value at maturity, as well as periodic interest payments.

Evidence

Information or documentation used to support or verify entries in the accounting records or financial statements.

Unsecured Bonds

Bonds issued without collateral, relying solely on the issuer's creditworthiness.

Q5: Reasons that firms may find themselves with

Q9: The biggest advantage of the current rate

Q16: A/an _ is a contract to lock

Q17: Which of the following is NOT an

Q24: Which of the following are characteristics of

Q27: Moody's rates international bonds at the request

Q43: Oil deposits found on the north slope

Q50: Reinvoicing centers provide the following benefits:<br>A) Aid

Q57: Currency futures contracts have become standard fare

Q68: Which of the following are used to