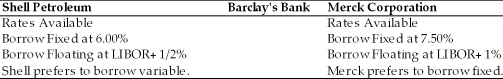

TABLE 15.2

Use the information to answer following question(s) .

-Refer to Table 15.2. Which of the following are viable rates for the swap agreements with Barclay's Bank by Shell and Merck?

Definitions:

Predetermined Overhead Rate

The rate used to allocate manufacturing overhead to products, calculated before the period begins based on estimated costs and activity levels.

Direct Labor-Hours

A measure used in accounting to allocate costs, referring to the total hours worked by employees directly involved in the manufacturing process.

Job-Order Costing System

A cost accounting system that accumulates costs incurred according to each job or project, suitable for industries where goods or services are produced on a custom basis.

Predetermined Overhead Rate

is calculated before a period begins and is used to allocate manufacturing overhead costs to products based on a chosen activity basis, such as labor hours or machine hours.

Q3: Which is NOT considered a shortcoming of

Q5: The domestic theory of optimal capital structure

Q7: If a firm's expected returns are more

Q22: Refer to Instruction 21.1. If the U.S.

Q27: If a portfolio is constructed with only

Q34: The primary goal of both domestic and

Q36: "If the United States is to remain

Q39: Refer to Instruction 15.1. Which strategy (strategies)

Q46: The accounts payable period of the operating

Q59: Consider two different foreign subsidiaries of Georgia-Pacific