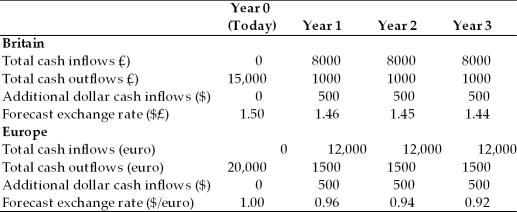

TABLE 19.1

Use the information to answer following question(s) .

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

-Refer to Table 19.1. Which of the following best summarizes the preliminary results of the investment analysis for the two prospective investments.

Definitions:

Stamp Act

A 1765 British law that imposed a tax on all paper documents in the American colonies, sparking widespread protest and helping to fuel the American Revolutionary movement.

Declare Independence

The act of a region or group formally stating their intention to become independent and govern themselves, often through a formal declaration.

British Militaries

The armed forces of the United Kingdom, consisting of the Royal Navy, British Army, and Royal Air Force.

George Washington

The first President of the United States, serving from 1789 to 1797, a Founding Father, and Commander-in-Chief of the Continental Army during the American Revolutionary War.

Q6: Firms might be tempted to order _

Q6: A basis point is _.<br>A) 1.00%<br>B) 0.10%<br>C)

Q11: If there is an excess demand for

Q17: Of the following, which was NOT cited

Q18: Resources found in nature, such as land,

Q21: An increase in supply will result in:<br>A)

Q42: If an economy is currently producing at

Q56: Which of the following could not result

Q63: Refer to Diagram 4-1. When price is

Q101: Suppose the equilibrium price of oranges is