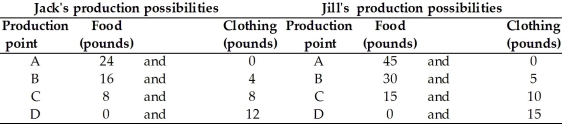

-In the table above,Jack's comparative advantage is producing ________ and Jill's comparative advantage is producing ________.

Definitions:

Average Tax Rate

The percentage representation of total taxes paid in relation to the overall taxable income or expenditure.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, influencing decisions about whether to engage in activities that will produce additional income.

Tax Liability

The total amount of tax that an individual or entity is legally obligated to pay to a tax authority.

Social Security Tax

A tax levied on both employers and employees to fund the Social Security program, typically taken as a percentage of wages.

Q25: Most of the world's population lives in<br>A)

Q41: The decisions of firms and households are<br>A)

Q90: In the above figure, an increase in

Q95: Compared to the world, the rate of

Q129: If Country A can produce an extra

Q139: To increase its economic growth, a nation

Q185: Property taxes are a major source of

Q199: The above figure shows the PPF for

Q227: If both the supply and demand curves

Q263: If the costs to produce pizza increase,