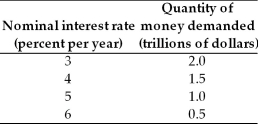

-The above table has the demand for money schedule.

a. If the Fed sets the quantity of money equal to $1.0 trillion, what is the equilibrium nominal interest rate?

b. If the Fed wants the interest rate to be 4 percent, what must it do?

Definitions:

Convertible Bonds

Bonds that can be converted into a predefined amount of the issuing company's equity at certain times during their life, usually at the discretion of the bondholder.

Conversion Price

In finance, the Conversion Price is the predetermined price at which convertible securities can be exchanged for common shares of the issuing company.

Option Contract

A financial derivative that gives the buyer the right, but not the obligation, to buy or sell an asset at a specified price on or before a specified date.

Exercise Price

The cost at which an options contract's owner has the right to purchase or sell the underlying asset.

Q24: Which of the following shifts the aggregate

Q51: Which of the following does NOT affect

Q52: If Joe deposits $2,000 in his bank

Q104: In the money market, if the price

Q116: The Fed's policy is determined by the<br>A)

Q121: A change in the price level produces

Q177: Quantitative easing by the Fed refers to<br>A)

Q220: The table above gives data for the

Q283: On a graph of the consumption function,

Q290: A currency drain is cash _ and