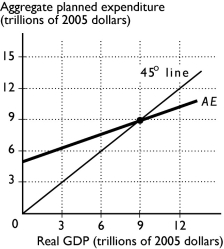

-In the figure above, if real GDP is $6 trillion, aggregate planned expenditure is

Definitions:

American Opportunity Tax Credit

A credit for qualified education expenses paid for an eligible student for the first four years of higher education, aimed at making college more affordable.

Lifetime Learning Credit

A tax credit available to U.S. taxpayers to offset the costs of post-secondary education for themselves, their spouse, or dependents.

Form 1116

Form 1116 is used by taxpayers to claim the Foreign Tax Credit, which is a credit for income taxes paid to a foreign country, reducing the U.S. tax liability on foreign income.

Foreign Tax Credit

A tax credit that allows taxpayers to offset income taxes paid to foreign governments against their U.S. tax liabilities, to avoid double taxation of the same income.

Q5: If the price of oil rises, the<br>A)

Q27: If government expenditures on goods and services

Q67: When tax revenue _ outlays is negative,

Q120: As real U.S.GDP increases, U.S.income increases and

Q160: Inflation is a tax because as the

Q194: In the figure above, the natural unemployment

Q198: Potential GDP<br>A) increases as the price level

Q211: An economy is at a full-employment equilibrium,

Q221: Which of the following events could result

Q225: If the money wage rate and the