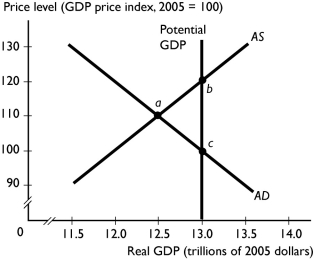

-The economy is at the equilibrium shown at point a in the above figure.If the Fed

Definitions:

U.S. Income Tax

A tax imposed by the U.S. government on the income earned by individuals, corporations, estates, and other entities.

Vertical Equity

The principle that people with higher incomes should pay more in taxes than those with lower incomes, reflecting a progressive tax system.

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount on which the tax is imposed.

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases.

Q39: In the foreign exchange market, the<br>A) quantity

Q85: In the labor market, the income tax

Q87: What is the natural rate hypothesis?

Q104: If we compare the United States to

Q104: If official reserves increase, then we know

Q115: Although _ initially proposes and ultimately approves

Q150: If the Fed lowers the interest rate,

Q165: In 2007, a dollar could be traded

Q198: As a result of U.S.tariffs imposed on

Q199: If the Fed wants to maintain a