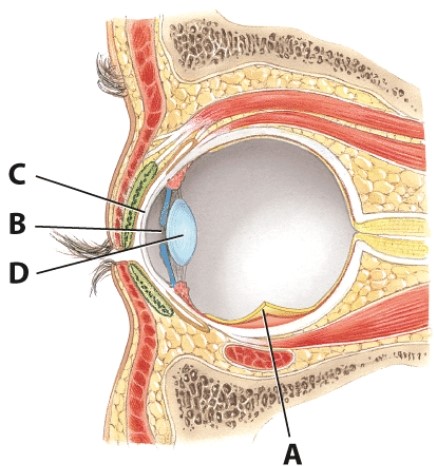

What is the name of structure B?

Definitions:

Deferred Tax Assets

Assets on a company's balance sheet that may be used to reduce future tax liability resulting from temporary timing differences between accounting and tax treatments.

Current Tax Liabilities

Taxes owed to the government within the current fiscal year.

Temporary Difference

Refers to the differences that arise between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Interest On Municipal Bonds

The periodic payments made to investors of municipal bonds, often exempt from federal and sometimes state and local taxes.

Q3: When does the muscle labeled C contract?

Q10: The exchange of gases occurs in the:<br>A)trachea.<br>B)terminal

Q19: Which layer of the skin contains the

Q22: How does the immune system defend against

Q27: Quickening occurs during the?<br>A)Late embryonic stage<br>B)First trimester<br>C)Second

Q30: Hormone A is released under which conditions?

Q37: President John F.Kennedy suffered from Cushing's disease.

Q39: The pH of the blood is influenced

Q46: Which virus can lead to cervical cancer?<br>A)HIV<br>B)Hepatitis

Q71: A closed reduction is when aligning a