The following questions refer to Figure 27.1.

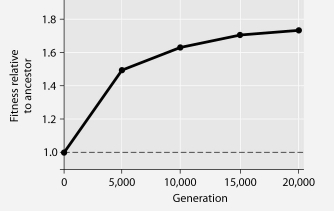

In this eight-year experiment, 12 populations of E. coli, each begun from a single cell, were grown in low-glucose conditions for 20,000 generations. Each culture was introduced to fresh growth medium every 24 hours. Occasionally, samples were removed from the populations, and their fitness in low-glucose conditions was tested against that of members sampled from the ancestral (common ancestor) E. coli population.

Figure 27.1

-Which of the following, if it occurs in the absence of any other type of adaptation listed here, is least reasonable in terms of promoting bacterial survival over evolutionary time in a low-glucose environment?

Definitions:

Tax Effects

Tax effects refer to the impact of tax laws on an individual's or company's financial decisions and operations, affecting net income, investment choices, and cash flows.

After-Tax Cost

The net cost of a financial transaction after factoring in the effects of taxes.

Straight-Line Method

A method of calculating depreciation of an asset, where the asset's cost is evenly spread over its useful life, resulting in equal annual depreciation expenses.

Salvage Value

The estimated residual value of an asset at the end of its useful life, often considered for depreciation calculations.

Q2: Which of the following is (are)unique to

Q23: Fragments of DNA have been extracted from

Q41: The harpy eagle, Harpia harpyja, is the

Q42: According to the phylogenies depicted in the

Q43: Which of the following factors does not

Q51: Carpels and stamens are<br>A)sporophyte plants in their

Q61: Which term best describes what has occurred

Q70: In Fred Griffith's experiments, harmless R strain

Q78: Entrepreneurs attempted, but failed, to harvest nuts

Q89: If haustoria from the fungal partner were