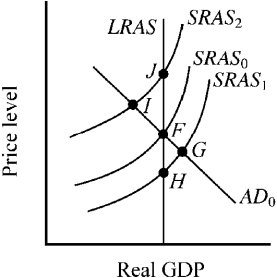

Use the figure below to answer the following question(s) .

Figure 10-2

-At which point in Figure 10-2 is the economy experiencing an economic recession?

Definitions:

Black-Scholes OPM

A model used to calculate the theoretical price of European put and call options, based on factors including the stock's current price, its volatility, the option's strike price, and the risk-free interest rate.

National Paper

Debt instruments issued by a government to finance its national activities and projects.

Risk-free Rate

The theoretical return on an investment without any risk of financial loss, typically represented by the yields on government securities.

Put Option

A financial contract that gives the holder the right, but not the obligation, to sell a specific amount of an underlying asset at a set price within a specified timeframe.

Q30: Which of the following is the best

Q31: During an economic contraction, housing and stock

Q65: Other things constant, which of the following

Q68: Which of the following will lead to

Q93: If the economy is experiencing inflationary boom,

Q96: Which of the following provides the clearest

Q120: If fiscal policy is going to exert

Q136: The Keynesian model provided an explanation for<br>A)

Q168: Which of the following factors would increase

Q174: With the passage of time, which of