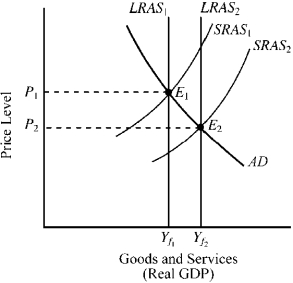

Use the figure below to answer the following question(s) .

Figure 10-11

-In Figure 10-11,which of the following would most likely cause the movement from point E₁ to point E₂?

Definitions:

Bond's Price

The price of a bond is the present value of its expected future cash flows, such as interest payments and the return of principal at maturity.

Interest Rate Price Risk

The risk that the value of an investment will decrease due to a change in interest rates.

Zero Coupon Bond

A type of bond that does not pay interest during its life but is sold at a deep discount from its face value.

Reinvestment Rate Risk

The risk that cash flows from an investment will be reinvested at a lower interest rate than the original investment rate, affecting future returns.

Q1: If there is a "long and variable

Q4: The primary source of revenue for the

Q20: Which of the following is a potential

Q67: During the second half of 2008, the

Q85: Which of the following will most likely

Q99: Refer to Figure 11-2. When the economy

Q105: During the financial crisis of 2008, Fed

Q180: The federal funds market is the market

Q181: When an economy is in a recession,<br>A)

Q190: The Fed's sale of U.S. government securities