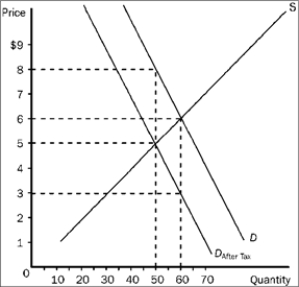

Figure 4-20

-Refer to Figure 4-20. The burden of the tax on sellers is

Definitions:

Elasticities

Measures of how much the quantity demanded or supplied of a good responds to changes in prices, income, or other factors.

Demand

The quantity of a good or service that consumers are willing and able to purchase at various price levels at a given point in time.

Supply

The total amount of a specific good or service available for purchase at any given price level, influenced by costs, technological innovations, and other factors.

Deadweight Loss

A loss of economic efficiency that can occur when equilibrium for a good or service is not achieved or is not achievable.

Q17: Refer to Figure 4-8. Which of the

Q49: Public choice theory indicates someone who spends

Q60: When a government subsidy is granted to

Q78: The actual incidence of a tax<br>A) depends

Q91: Answer the following questions:<br>a.What are the three

Q91: Use the table below to choose the

Q93: Suppose that the producers of copper are

Q117: Frictional unemployment<br>A) would be eliminated if the

Q151: Refer to Figure 3-13. The market for

Q175: If the federal government began granting a