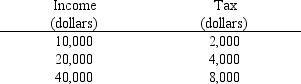

Use the table below to choose the correct answer.

The tax schedule shown here is

Definitions:

Cost Object

Any item for which a separate measurement of costs is desired, including products, services, projects, or customers.

Direct Costs

Expenses directly associated with the production of goods or services, such as raw materials and labor.

Variable Costs

Costs that vary directly with the level of production or volume of output, including materials and labor directly involved in a company's manufacturing process.

Direct Labor Cost

The total cost of all labor that can be directly attributed to the production or manufacturing of goods or services.

Q36: Current evidence indicates that the earliest hominids

Q90: Sam lives in a town with a

Q97: The Laffer curve illustrates the relationship between<br>A)

Q112: Susan says, "If the price of wool

Q125: Anna has just finished high school and

Q142: Profits and losses play an important role

Q168: An excise tax levied on a product

Q183: Taxes create deadweight losses because they<br>A) reduce

Q190: The definition of the unemployment rate is<br>A)

Q201: A tax tends to<br>A) increase formal market