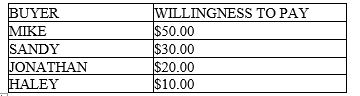

Table 3-1

-Refer to Table 3-1. If the table represents the willingness to pay of four buyers and the price of the product is $18, then their total consumer surplus is

Definitions:

Qualifying Relative

A dependent who does not meet the "qualifying child" criteria but qualifies for certain tax benefits by meeting specific residency, relationship, and support tests.

Qualifying Child

A dependent who meets specific IRS criteria related to age, relationship, residency, support, and filing status for potential tax benefits.

Head of Household

A tax filing status for individuals living in the U.S. who are unmarried and support a qualifying person, offering more favorable tax rates and deductions.

Adjusted Gross Income (AGI)

A measure of income calculated from your gross income and used to determine how much of your income is taxable.

Q5: Relative to body size, primate brain size<br>A)is

Q45: A tax for which the average tax

Q57: If price rises, what happens to the

Q78: "He [the producer] intends only his gain,

Q111: Refer to Figure 3-23. It is apparent

Q149: An important assumption that is made when

Q150: Refer to Figure 3-13. The market for

Q152: Saccharin and aspartame are both low-calorie substitutes

Q179: Kathy works full time during the day

Q190: In a market economy, which of the