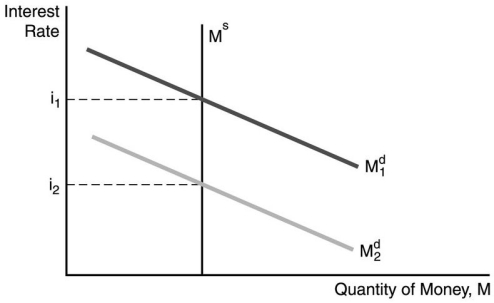

-In the figure above, the decrease in the interest rate from i₁ to i₂ can be explained by ________.

Definitions:

APT

Stands for Arbitrage Pricing Theory, a financial model that determines asset prices based on the relationship between expected risk and expected return.

Conditional CAPM

An extension of the Capital Asset Pricing Model (CAPM) that allows for the beta coefficient to change depending on economic conditions or time.

Empirical Returns

Returns on an investment that are based on observed, historical real-world data rather than theoretical or expected outcomes.

Conventional CAPM

The Capital Asset Pricing Model, a financial model that describes the relationship between systematic risk and expected return for assets, typically used for pricing risky securities.

Q25: The conversion of a barter economy to

Q31: One possible reason for slower growth in

Q38: A business cycle expansion increases income,causing money

Q39: When yield curves are flat<br>A)long-term interest rates

Q47: From 1980-1985,the dollar strengthened in value against

Q55: Bonds that are sold in a foreign

Q59: Both the CAPM and APT suggest that

Q59: Equity contracts account for a small fraction

Q60: What is the return on a 5

Q62: When compared to exchange systems that rely