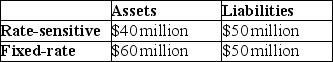

Use the following table to answer the question :

-Assuming that the average duration of its assets is four years,while the average duration of its liabilities is three years,then a 5 percentage point increase in interest rates will cause the net worth of First National to ________ by ________ of the total original asset value.

Definitions:

Compound Instruments

Financial instruments that contain both a liability and equity element, requiring separation for accounting purposes.

Liability

A financial obligation or debt owed by a company to another entity, payable in the future.

Legally Enforceable

Describes a contract or agreement that is binding under law and can be upheld in a court.

Future Transfer

A financial arrangement or transaction planned to be executed at a future date.

Q10: If expectations of the future inflation rate

Q13: The advantage of forward contracts over future

Q26: U.S.government bonds have no default risk because<br>A)they

Q48: The large number of banks in the

Q49: Which of the following are bank assets?<br>A)the

Q49: According to the segmented markets theory of

Q63: If,after a deposit outflow,a bank needs an

Q64: A plot of the interest rates on

Q70: Property that is pledged to the lender

Q91: The presence of so many commercial banks