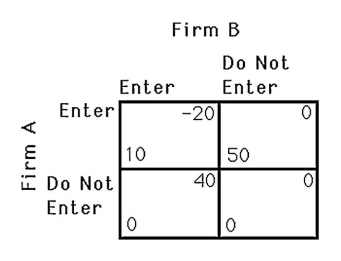

-The above figure shows the payoff to two airlines,A and B,of serving a particular route.If the two airlines must decide simultaneously,which one of the following statements is TRUE?

Definitions:

Long-Term Debt

Borrowings of a company not due for payment within the upcoming 12-month period, often used for major investments or acquisitions.

Total Capitalization

The sum of a company's long-term debt, equity, and retained earnings, reflecting the total funding sourced from investors and creditors.

Debt-Equity Ratio

A financial ratio used to understand a company's leverage, by dividing its complete liabilities by the equity available to shareholders.

Price-Earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, used to gauge the relative value of a stock.

Q15: Bob invests $50 in an investment that

Q15: In the long run<br>A) the firm shuts

Q29: A consumer's reservation price is the<br>A) amount

Q40: With two-part pricing<br>A) the consumer puts down

Q42: Firms might vertically disintegrate when<br>A) it becomes

Q56: Vertical integration<br>A) is always driven by profitability

Q61: Which of the following statements about private

Q86: The key economic difference between expected utility

Q86: Why doesn't a firm price discriminate based

Q111: Asymmetric information is where<br>A) everyone has the