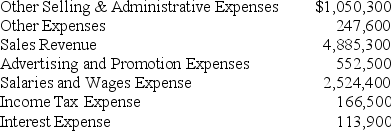

Use the following Year 3 data to prepare the annual income statement for Kvass,Inc.

Definitions:

Average Tax Rate

The fraction of total income that is paid as taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Marginal Tax Rate

The rate at which the last dollar of a person's income is taxed, indicating how much tax will be paid on an additional dollar of income.

Income Before Taxes

The gross income a person or corporation earns before taxes are deducted.

Marginal Tax Rate

The rate at which an additional dollar of income is taxed, serving as a useful measure of the impact of taxes on incentives to earn more.

Q19: Having a low selection ratio allows an

Q26: To successfully negotiate a job offer it

Q42: U.S.GAAP are:<br>A) another term for IFRS.<br>B) the

Q60: In Year 2,the Denim Company bought an

Q61: An economic resource that is owned by

Q86: Choose the appropriate letter to match the

Q151: The owner is not responsible for the

Q191: Borrowing from a bank is a(n):<br>A) operating

Q205: When cash is paid for something that

Q214: The accrual adjustment recorded to adjust for