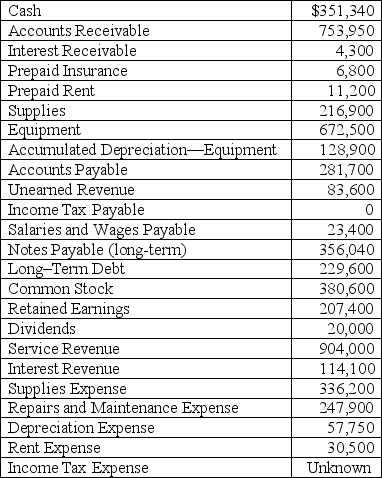

All of the accounts of the Grass is Greener Company have been adjusted as of December 31,2016,with the exception of income taxes incurred but not yet recorded.Those account balances appear below.All have normal balances.The estimated income tax rate for the company is 40%.

Required:

Part a.Calculate the income before income tax.

Part b.Calculate the income tax expense.

Part c.Calculate the net income.

Definitions:

Unit Product Cost

The total cost (direct materials, direct labor, and overhead) to produce one unit of a product.

Absorption Costing

An accounting method that includes all manufacturing costs (direct material, direct labor, and both variable and fixed manufacturing overhead) in the cost of a product.

Net Operating Income

A company's total earnings from its operations, excluding taxes and interest.

Absorption Costing

A cost accounting procedure that comprises adding up all expenses involved in manufacturing—direct materials, direct labor, and manufacturing overhead, both fixed and variable—to the cost of the product.

Q7: A check that was outstanding on last

Q24: BetterBuy sells $50,000 of TVs to a

Q27: A company can use different methods for

Q35: Generally,a physical count of inventory is performed

Q37: Which of the following situations results in

Q86: Quartz Instruments had Retained Earnings of $145,000

Q120: A company using a perpetual inventory system

Q141: Which account below is a temporary account?<br>A)

Q169: The Don't Tread on Me Tire Company

Q213: After adjusting entries are prepared and posted,but