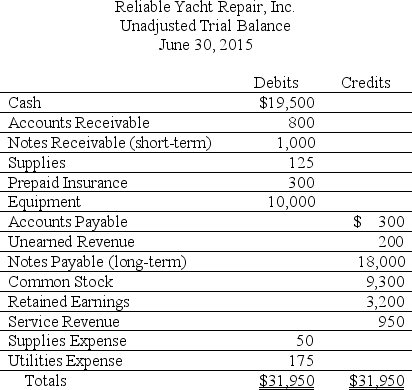

Lisa and Charlie operate a yacht maintenance service that they incorporated as Reliable Yacht Repair,Inc.They recently talked to their banker about obtaining a loan.The banker has requested their most recent financial statements prepared in accordance with GAAP.Lisa and Charlie are unsure of how to proceed and ask you for advice.You asked for their most recent unadjusted trial balance,which follows:

Required:

Review the unadjusted trial balance and identify the accounts that might require adjustment at June 30,2015.Then,describe what information you would need in order to determine the nature and amount of the adjusting entry for each of the accounts identified.

Definitions:

Deadweight Losses

Economic inefficiencies that occur when the equilibrium in a market is not achieved or is distorted, typically resulting in lost welfare or inefficiency.

Ability-to-Pay Principle

A taxation principle that suggests taxes should be levied according to an individual's or entity's ability to pay, implying those with higher income should pay more taxes.

Taxes

Mandatory fiscal contributions or other forms of levies required from taxpayers by governmental bodies to support government expenditures and diverse public costs.

Regressive Tax

A tax system where the tax rate decreases as the taxable amount increases, placing a higher relative burden on lower-income earners.

Q16: Which of the following expressions correctly describes

Q47: An overstatement of ending inventory will cause

Q60: Use the above information to answer the

Q63: A process for approving and documenting all

Q86: Quartz Instruments had Retained Earnings of $145,000

Q92: Your company's president donates a large amount

Q100: The failure to record an accrual adjustment

Q161: Which of the following statements about an

Q174: The period of time from buying goods

Q190: Your business purchased an investment security on