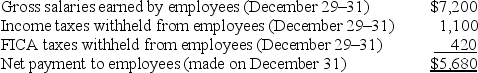

Wade Industries reported the following information in its accounting records on December 31,2015:

The employees were paid $5,680 on December 31,2015,but the withholdings have not yet been remitted nor have the matching employer FICA contributions.

Required:

Part a.Compute the total payroll costs relating to the period from December 29-31.(Assume $560 in total unemployment taxes.)

Part b.Show the accounting equation effects and give the journal entries on December 31 to adjust for salaries and wages relating to December 29-31,2015.

Part c.Show the accounting equation effects and give the journal entries on December 31 to adjust for payroll taxes relating to December 29-31,2105.

Definitions:

Night Shift

A work shift that takes place during the nighttime hours, often in industries such as healthcare, security, and manufacturing.

Caffeine Intake

The consumption of caffeine, a stimulant, through foods and beverages like coffee, tea, and chocolate.

Frequent Breaks

Short periods of rest taken regularly during activities or work to prevent fatigue, enhance performance, and support wellbeing.

Rest Days

Scheduled periods of time dedicated to recovery and relaxation, away from work or intense physical activity.

Q13: The Dewie,Cheatum,and Howe partnership paid each of

Q19: The general goal of horizontal analyses is

Q39: If a company produces the same number

Q68: Many lending agreements require the borrowing company

Q72: Hubbard Street Dance Company sells subscriptions for

Q96: A corporation had 50,000 shares of $20

Q126: The formula for calculating depreciation expense using

Q135: Marble Corporation had the following balances in

Q208: Cash flows from financing activities:<br>A) includes all

Q265: Depreciation and impairment are different in that:<br>A)