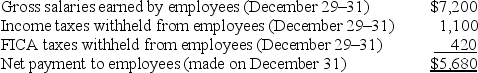

Wade Industries reported the following information in its accounting records on December 31,2015:

The employees were paid $5,680 on December 31,2015,but the withholdings have not yet been remitted nor have the matching employer FICA contributions.

Required:

Part a.Compute the total payroll costs relating to the period from December 29-31.(Assume $560 in total unemployment taxes.)

Part b.Show the accounting equation effects and give the journal entries on December 31 to adjust for salaries and wages relating to December 29-31,2015.

Part c.Show the accounting equation effects and give the journal entries on December 31 to adjust for payroll taxes relating to December 29-31,2105.

Definitions:

Q2: Nancy O'Rode,doing business as O'Rode Consulting,performs consulting

Q22: State laws often restrict dividends to the

Q53: The Discounts on Bonds Payable account is

Q89: Assuming nothing else changes,a decrease in average

Q139: Tangible assets are first recorded at:<br>A) all

Q142: On the declaration date,the company:<br>A) debits Dividends

Q175: Choose the appropriate letter of the explanation

Q190: If a company wants exclusive rights to

Q203: Using straight-line amortization,when a bond is sold

Q235: Amortization is an adjusting entry that records