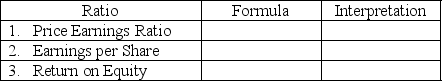

Complete the table below by filling in the Formula blank with the letter that corresponds to the correct formula for each ratio and filling in the Interpretation blank with the letter that corresponds to the interpretation provided.Not all ratio formulas and interpretations will be used.

Ratio Formulas

A.365 ÷ Inventory Turnover

B.(Sales - Cost of Goods Sold)÷ Sales

C.Net Income ÷ Sales

D.Net Operating Income ÷ Interest Expense

E.(Net income - Preferred dividends)÷ Average number of common shares outstanding

F.Total Liabilities ÷ Total Assets

G.Current stock price (per share)÷ Earnings per Share

H.(Net income - Preferred dividends)÷ Average common stockholders' equity

Ratio Interpretations

A.The portion of sales that is attributable to merchandise profit.

B.Ability of a company to pay its short-term debts as they come due.

C.The percent of each sales dollar that is left over after covering costs and expenses.

D.How many times more than the current year's earnings investors are willing to pay for a company's common stock

E.Ability of a company to quickly pay its short-term debts as they come due.

F.The portion of a company's total financing that comes from debt.

G.The amount of income generated for each share of common stock owned by stockholders

H.How effectively a company is using its assets to generate revenue.

I.The amount of income earned for each dollar of common stockholders' equity.

Definitions:

Manufacturing Overhead

The total of all overhead costs associated with the manufacturing process other than direct materials and direct labor. This includes costs such as maintenance, utilities, and equipment depreciation.

Direct Manufacturing Cost

Expenses directly tied to the production of goods, such as labor and materials, but excluding indirect costs like overhead.

Opportunity Cost

The value of the next-best alternative that is foregone when making a decision, representing the trade-offs associated with choosing one option over another.

Differential Cost

The difference in cost between two alternative decisions or changes in output levels.

Q1: When the indirect method is used,if a

Q51: Subtracting a decrease in Unearned Revenue from

Q93: A company's cash flows from investing activities

Q113: Selected financial information presented below was obtained

Q117: Which of the following statements about business

Q136: Darwin was not the first to suggest

Q139: Which of the following statements about stock

Q166: A stock split increases total stockholders' equity.

Q180: Assume that the direct method is used

Q187: The entry to record a bond retirement