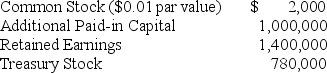

At the end of the prior year,Atoka Industries reported the following account balances:

The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in in the current year,what journal entry must be prepared to record the transaction?

Definitions:

Excise Tax

A tax imposed on specific goods or services at purchase such as gasoline, tobacco, and alcohol.

Highly Inelastic

Describes a situation where the demand or supply for a good or service is hardly affected when the price changes.

Highly Elastic

Describes a situation where the demand or supply of a product changes significantly in response to changes in price.

Excise Tax

A tax on the sale or consumption of specific goods or services, such as alcohol or gasoline.

Q8: Which of the following would be classified

Q13: The Dewie,Cheatum,and Howe partnership paid each of

Q20: The price-earnings ratio reveals information about the

Q28: A company's sales are $285,000 and $200,000

Q47: Current liabilities could include all of the

Q88: Which of the following measures would assist

Q99: Which of the following statements best describes

Q109: Core Corporation had 400,000 shares of $2

Q167: A company purchased land for its natural

Q264: Sony,Inc.spent $1,000,000 of development cost for commercially