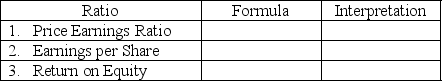

Complete the table below by filling in the Formula blank with the letter that corresponds to the correct formula for each ratio and filling in the Interpretation blank with the letter that corresponds to the interpretation provided.Not all ratio formulas and interpretations will be used.

Ratio Formulas

A.365 ÷ Inventory Turnover

B.(Sales - Cost of Goods Sold)÷ Sales

C.Net Income ÷ Sales

D.Net Operating Income ÷ Interest Expense

E.(Net income - Preferred dividends)÷ Average number of common shares outstanding

F.Total Liabilities ÷ Total Assets

G.Current stock price (per share)÷ Earnings per Share

H.(Net income - Preferred dividends)÷ Average common stockholders' equity

Ratio Interpretations

A.The portion of sales that is attributable to merchandise profit.

B.Ability of a company to pay its short-term debts as they come due.

C.The percent of each sales dollar that is left over after covering costs and expenses.

D.How many times more than the current year's earnings investors are willing to pay for a company's common stock

E.Ability of a company to quickly pay its short-term debts as they come due.

F.The portion of a company's total financing that comes from debt.

G.The amount of income generated for each share of common stock owned by stockholders

H.How effectively a company is using its assets to generate revenue.

I.The amount of income earned for each dollar of common stockholders' equity.

Definitions:

Fiscal Year

A one-year period adopted by businesses and governments for accounting and financial reporting, which may or may not align with the calendar year.

Preferred Stock

A class of stock that offers its holders priority over common stockholders in the distribution of dividends and assets.

Common Stock

Equity ownership in a corporation, with the right to vote on corporate matters and receive dividends.

Dividends Per Share

The total amount of dividends declared for each share of stock issued, showing how much shareholders receive from the net profits of the company.

Q18: Net income was $418,600 in the current

Q33: Suppose a company generally records revenues and

Q56: Social dominance is an important factor in

Q108: Which of the following actions would likely

Q125: Company X has net sales revenue of

Q129: Use the information above to answer the

Q134: Which of the following statements about the

Q144: Extraordinary items:<br>A) are rare because the rules

Q166: The issue price of a bond is:<br>A)

Q229: If a company's P/E ratio suddenly decreases:<br>A)